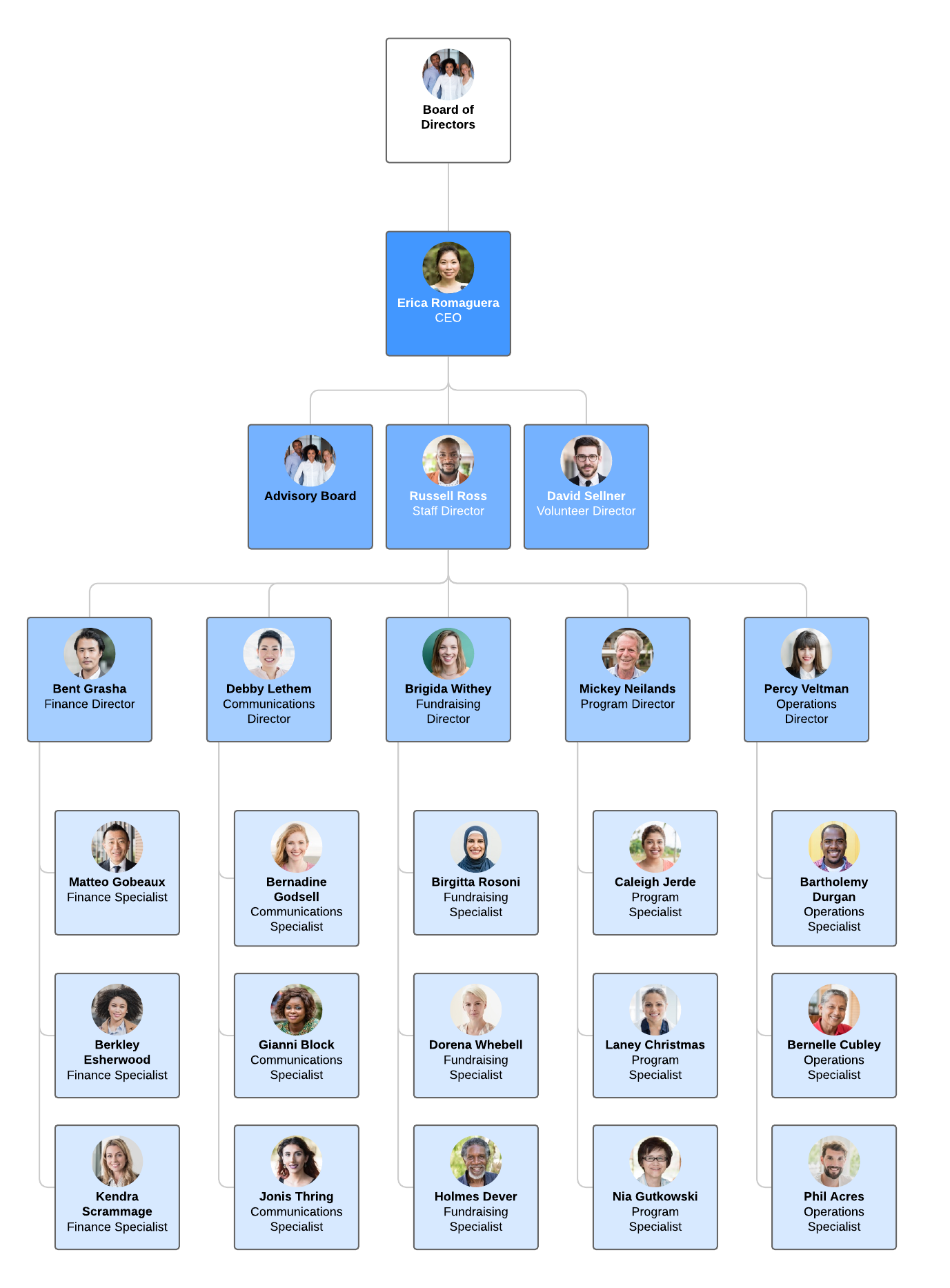

Financial management is a crucial part of running any business, whether it’s a small startup or a large corporation. Simply put, financial management is the process of managing a company’s finances to achieve its financial goals. This includes managing the company’s cash flow, making investment decisions, and analyzing financial statements.

The nature of financial management involves various aspects, such as planning, organizing, directing, and controlling financial activities within an organization. Effective financial management is critical to the success of any business, as it helps in maintaining financial stability, avoiding financial risks, and achieving financial objectives.

One of the key aspects of financial management is financial planning. This involves forecasting future financial needs and developing strategies to meet them. Financial planning helps in identifying the company’s financial strengths and weaknesses and taking appropriate actions to improve them.

Financial management also involves organizing financial resources and allocating them effectively. This includes managing the company’s capital, debt, and equity, and ensuring that funds are available when needed. Effective financial management also involves managing cash flow and ensuring that the company has enough cash to cover its expenses and pay its debts.

Another important aspect of financial management is financial analysis. This involves analyzing financial statements, such as balance sheets, income statements, and cash flow statements, to evaluate the company’s financial health and performance. Financial analysis helps in identifying areas where the company can improve its financial performance and make more informed financial decisions.

Financial management is an integral part of any organization or individual’s financial planning. It involves the planning, organizing, directing, and controlling of financial resources to achieve the financial objectives of an organization or individual. The importance of financial management cannot be overstated, as it plays a crucial role in the success of an organization or individual.

Here are some key reasons why financial management is so important:

- Helps achieve financial goals: Financial management helps individuals and organizations achieve their financial objectives by providing a framework for planning, organizing, directing, and controlling financial resources.

- Ensures financial stability: Effective financial management ensures the financial stability of an organization or individual by ensuring that they have enough resources to meet their financial obligations and achieve their financial goals.

- Facilitates decision-making: Financial management provides the necessary information and tools to make informed financial decisions. It helps individuals and organizations identify and evaluate financial opportunities, risks, and trade-offs.

- Enhances profitability: Effective financial management helps organizations and individuals optimize their financial resources and maximize their profitability. It involves managing costs, increasing revenue, and improving the efficiency of financial operations.

- Improves cash flow: Financial management helps organizations and individuals manage their cash flow effectively by ensuring that they have enough cash to meet their short-term financial obligations and invest in their long-term financial goals.

Finance within an Organization: Importance and Functions

Finance plays a crucial role in the success of any organization. It is essential to understand the importance of finance in an organization and how it functions to ensure its smooth functioning. In this article, we will discuss the importance of finance within an organization and its functions.

Importance of Finance within an Organization:

1. Financial Planning: Financial planning is the backbone of any organization. Finance helps in developing a sound financial plan that ensures the smooth running of the organization. It helps in determining the financial goals, objectives, and strategies required to achieve them.

2. Investment Decisions: Finance plays a critical role in the investment decisions of an organization. The finance department is responsible for identifying profitable investment opportunities and evaluating the risk and return associated with them.

3. Resource Allocation: The finance department is responsible for allocating resources effectively and efficiently. It helps in ensuring that the funds are available for the operations of the organization and that they are used appropriately.

4. Budgeting: Finance plays a significant role in budgeting. The finance department prepares and manages budgets for the organization, which helps in controlling costs and maximizing profits.

5. Cash Management: Finance is responsible for managing the cash flow of the organization. It helps in ensuring that there is enough cash available to meet the day-to-day expenses of the organization and to pay off any debts.

Functions of Finance within an Organization:

1. Financial Analysis: The finance department is responsible for analyzing the financial data of the organization. It helps in identifying the financial strengths and weaknesses of the organization and in developing strategies to address them.

2. Financial Reporting: The finance department prepares financial reports for the organization. It includes balance sheets, income statements, and cash flow statements. These reports provide important information to the stakeholders of the organization.

3. Risk Management: Finance plays a critical role in managing the risks associated with the operations of the organization. It helps in identifying potential risks and developing strategies to mitigate them.

4. Fundraising: The finance department is responsible for raising funds for the organization. It includes debt financing, equity financing, and other forms of financing.

5. Tax Management: Finance is responsible for managing the tax obligations of the organization. It helps in ensuring that the organization complies with all the tax laws and regulations.

Functions of Financial Management

- Financial Planning: Financial planning is the process of determining how much money an organization will need in the future and how it will acquire that money. Financial planning is essential for an organization because it helps it to make informed decisions about its future. The financial manager must evaluate the organization’s current financial situation, forecast future cash flows, and develop strategies to meet the organization’s financial goals.

- Capital Budgeting: Capital budgeting is the process of evaluating and selecting long-term investment projects. The financial manager must assess the expected cash flows from a project, the cost of the investment, and the potential risks associated with the investment. Capital budgeting is crucial for an organization because it determines how the organization will allocate its financial resources for the long term.

- Financial Control: Financial control is the process of monitoring and controlling the financial resources of an organization. The financial manager must ensure that the organization’s financial activities are in line with its goals and objectives. Financial control involves the creation of financial statements, budgeting, and the monitoring of cash flows.

- Financial Reporting: Financial reporting is the process of creating financial statements that accurately reflect an organization’s financial performance. The financial manager must prepare financial statements in accordance with generally accepted accounting principles (GAAP) and ensure that they are accurate and timely.

- Risk Management: Risk management is the process of identifying and managing the risks that an organization faces. The financial manager must assess the risks associated with the organization’s investments, financial activities, and business operations. The financial manager must develop strategies to manage these risks and ensure that the organization’s financial resources are protected.

Goal of Financial Management

The primary goals of financial management are to maximize shareholder wealth and to ensure the financial stability of the organization. Here are some more details on these goals:

- Maximizing shareholder wealth: The ultimate goal of financial management is to maximize shareholder wealth, which means increasing the value of the organization’s stock price. This can be achieved by maximizing profits, generating positive cash flows, and making sound investment decisions. The financial manager must balance the interests of shareholders with those of other stakeholders, such as customers, employees, and suppliers.

- Financial stability: Financial stability is another important goal of financial management. This means ensuring that the organization has sufficient liquidity to meet its short-term obligations, as well as enough long-term capital to fund growth and expansion. Financial stability also requires effective risk management, including identifying and managing financial risks such as credit risk, interest rate risk, and market risk.

- Efficient use of resources: Financial management also aims to ensure the efficient use of resources, including capital, labor, and materials. This involves monitoring and controlling costs, optimizing production processes, and making smart investment decisions.

- Enhancing reputation: The financial management function also plays a key role in enhancing the organization’s reputation and maintaining the trust of investors, creditors, and other stakeholders. This involves maintaining accurate financial records, ensuring compliance with laws and regulations, and communicating financial information clearly and transparently.

- [Resolving the Adventure Not Found Error in For the King 2](#) - [Understanding the Purpose of the Hardwork Skill in For the King 2](#) Upon liberating the prisoner from the cart in The Resistance chapter, the world unfurls for exploration. Roam the area until you chance upon an overturned wagon distinct from the prisoner cart, nestled in the Foothills area of the map. Should the wagon remain elusive, lean on Vision Scrolls or Find Distance items, available in town shops, dropped by enemies, or carried by specific characters such as the Scholar. Employ these tools to meticulously scrutinize the Foothills. Continue your exploration of the Foothills until you stumble upon the broken wagon. Once uncovered, assign any of your party members to investigate – no battle ensues, sparing your entire party from involvement. A notification will prompt you to the exact location of the Bandit Camp, where Hildegard's husband is being held captive. Liberate him from the camp to successfully fulfill this objective. These are the crucial steps to unraveling the mystery of Hildegard's husband in For the King 2. If you found this guide beneficial, consider exploring our diverse range of other informative guides.](https://meropaper.com/wp-content/uploads/2024/01/for-the-king-2-hildegard-husband-cart2-150x150.webp)