What is Bond Valuation ?

Bonds are a fundamental component of the financial markets and play a crucial role in investment portfolios. They offer investors a fixed income stream and serve as a means for governments, municipalities, and corporations to raise capital. Understanding bond valuation is essential for investors looking to make informed decisions and maximize their returns. In this chapter, we will explore the world of bonds and delve into the intricacies of bond valuation.

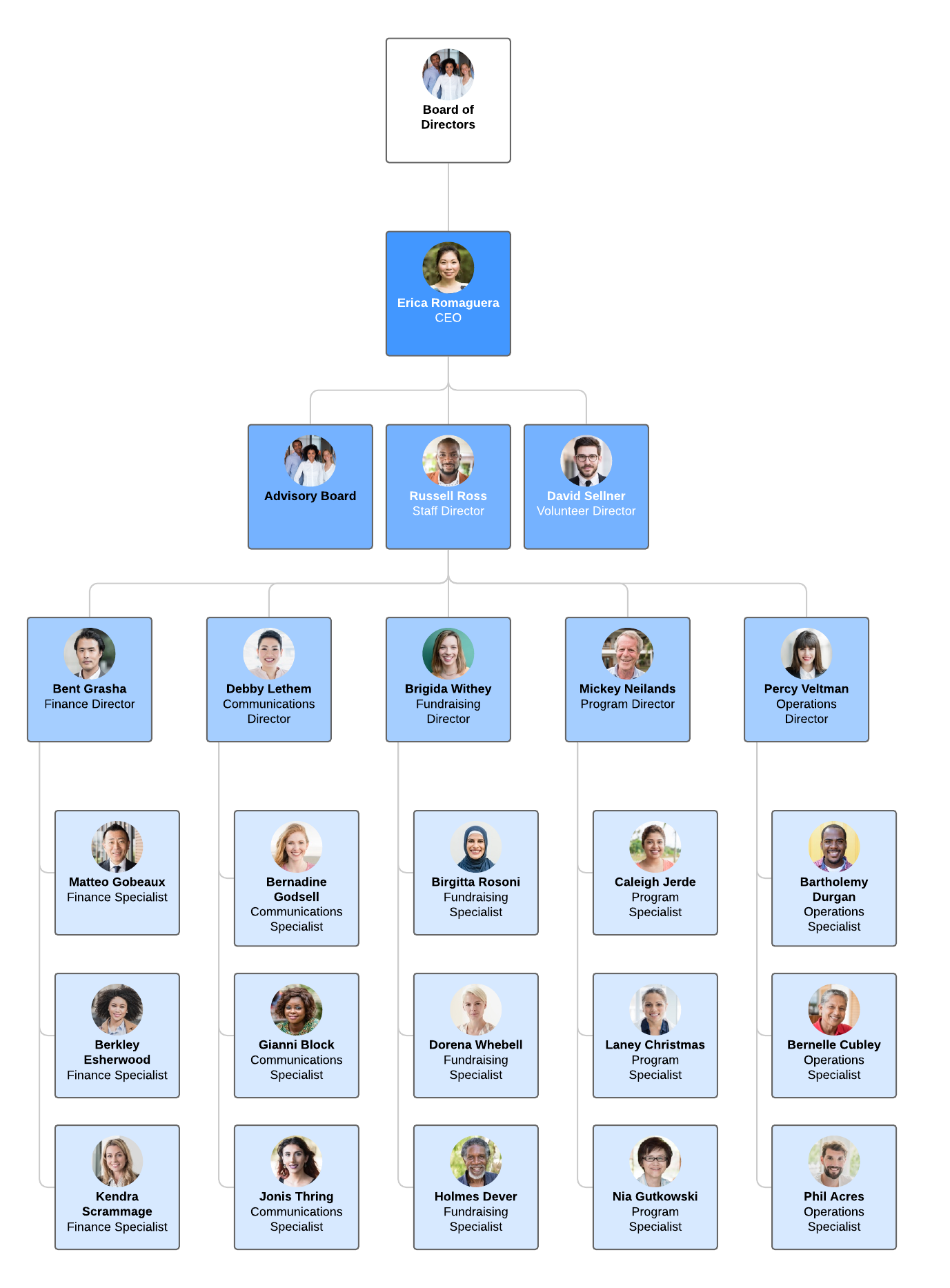

Key Features of Bond

| Key Features | Description |

|---|---|

| Principal/Face Value | The initial investment made by the bondholder, representing the amount that the bond issuer promises to repay at maturity. |

| Coupon Rate | The fixed annual interest rate paid by the bond issuer to the bondholder, expressed as a percentage of the bond’s face value. |

| Coupon Payments | Regular interest payments made by the bond issuer to the bondholder based on the coupon rate, providing a fixed income stream during the bond’s life. |

| Maturity Date | The date on which the bond reaches its full term, and the issuer is obligated to repay the bondholder the face value of the bond. |

| Yield | The return received by the bondholder from owning the bond, expressed as a percentage and taking into account coupon payments, purchase price, and time to maturity. |

| Credit Rating | Ratings assigned by independent agencies to assess the issuer’s creditworthiness, indicating the bond’s credit risk. Common agencies include Standard & Poor’s, Moody’s, and Fitch Ratings. |

| Callability | A provision that allows the issuer to redeem the bond before maturity, impacting the bondholder’s expected returns if the bond is called early. |

| Convertibility | An option for the bondholder to convert the bond into a predetermined number of shares of the issuer’s common stock. |

| Market Price | The price at which the bond trades in the secondary market, influenced by market conditions, interest rates, and investor demand. |

What is Financial Assets Valuation ?

Financial asset valuation refers to the process of determining the fair value or worth of various financial instruments, such as stocks, bonds, derivatives, commodities, and currencies. It involves assessing the intrinsic value of these assets based on factors such as market conditions, cash flows, risk profiles, and other relevant considerations.

The valuation of financial assets is essential for investors, financial institutions, and companies to make informed decisions about buying, selling, or holding these assets. Accurate valuation enables market participants to assess the attractiveness of investment opportunities, manage risk effectively, and determine the fair pricing for trading purposes.

There are various methods and approaches used for financial asset valuation, depending on the specific asset class and market conditions. Some commonly employed valuation techniques include:

- Market-based Valuation: This approach relies on the current market prices of comparable assets to determine the value of a financial instrument. It involves analyzing recent transactions and market data to assess the supply and demand dynamics and derive the asset’s fair value.

- Income-based Valuation: This method focuses on estimating the future cash flows generated by the financial asset. By discounting these cash flows to their present value, considering the appropriate discount rate, investors can determine the value of the asset. This approach is commonly used for bonds, where cash flows are derived from coupon payments and principal repayment.

- Option Pricing Models: Option pricing models, such as the Black-Scholes model, are employed to value financial instruments with embedded options, such as options and convertible securities. These models take into account factors such as underlying asset price, strike price, time to expiration, volatility, and risk-free interest rates.

- Fundamental Analysis: This approach involves analyzing the financial health, performance, and prospects of a company to estimate the value of its equity or stock. Fundamental analysis considers factors such as earnings, revenue, growth rates, industry dynamics, and macroeconomic conditions.

- Monte Carlo Simulation: This technique utilizes statistical modeling and simulation to estimate the value of complex financial instruments, especially derivatives. It involves generating multiple scenarios based on various input variables and running simulations to derive a range of possible outcomes.

Financial asset valuation is subject to various challenges and uncertainties. Factors such as market volatility, changes in interest rates, geopolitical events, and investor sentiment can impact the value of financial assets. Additionally, the availability and reliability of data, as well as the assumptions made during the valuation process, can influence the accuracy of the valuation results.

What is Bond Valuation ?

Bond valuation involves calculating the present value of a bond’s future cash flows, considering factors such as coupon payments, time to maturity, market interest rates, and the bond’s face value. Here are the formulas commonly used for bond valuation:

- Present Value of Coupon Payments:

PVCP = C * [1 – (1 + r)^(-n)] / r

Where: PVCP = Present value of coupon payments C = Coupon payment r = Discount rate (yield to maturity divided by the number of coupon periods per year) n = Number of periods (remaining coupon payments)

- Present Value of the Face Value (Principal):

PVFV = F / (1 + r)^n

Where: PVFV = Present value of the face value (principal) F = Face value of the bond r = Discount rate (yield to maturity divided by the number of coupon periods per year) n = Number of periods (remaining coupon payments)

- Total Present Value of the Bond:

PV Bond = PVCP + PVFV

Where: PV Bond = Total present value of the bond

- Yield to Maturity (YTM):

The yield to maturity represents the internal rate of return (IRR) earned by an investor who holds the bond until maturity. It is the discount rate that makes the present value of the bond’s cash flows equal to its market price. YTM can be calculated using iterative methods or financial calculators.

These formulas assume that coupon payments are reinvested at the same discount rate as the yield to maturity. In practice, market conditions and reinvestment rates may vary, affecting the actual returns of the bond.

It’s important to note that these formulas provide a basic framework for bond valuation. Advanced bond pricing models may incorporate additional factors, such as call or put options, credit risk, and market expectations, to provide more accurate valuations for complex bond structures.

When using these formulas, consider the appropriate discount rate based on market conditions and the risk profile of the bond. Additionally, ensure that the time periods and coupon payments are adjusted accordingly (e.g., semi-annual or annual periods).

Remember, bond valuation is a dynamic process, and market factors can influence bond prices. It’s crucial to continuously monitor and reassess bond valuations to make informed investment decisions.

What Are the Interest Rate on Bond’s Price ?

Understanding the relationship between market interest rates and bond prices is crucial for investors seeking to optimize their bond investments. Market interest rates have a significant impact on bond prices due to the concept of interest rate risk. In this article, we will delve into the inverse relationship between market rates and bond prices, explain the influence on coupon rates and present value calculations, and highlight the importance of duration in managing interest rate risk.

The Inverse Relationship Between Market Interest Rates and Bond Prices

- Explore the inverse relationship between market interest rates and bond prices.

- Learn how rising market rates lead to declining bond prices, and vice versa.

- Understand why investors find newly issued bonds with higher coupon rates more attractive, causing existing bond prices to adjust.

Impact on Coupon Rates and Present Value Calculations

- Explain the impact of market interest rates on bond coupon rates.

- Discover why rising market rates make existing bond coupon payments less attractive relative to higher prevailing rates.

- Discuss how changes in market rates affect the present value of a bond’s future cash flows, influencing bond prices.

The Importance of Duration in Managing Interest Rate Risk

- Highlight the significance of duration in assessing a bond’s sensitivity to changes in market interest rates.

- Explain how bonds with longer durations experience larger price fluctuations due to interest rate changes.

- Discuss how understanding duration helps investors manage interest rate risk and make informed bond investment decisions.

- [Resolving the Adventure Not Found Error in For the King 2](#) - [Understanding the Purpose of the Hardwork Skill in For the King 2](#) Upon liberating the prisoner from the cart in The Resistance chapter, the world unfurls for exploration. Roam the area until you chance upon an overturned wagon distinct from the prisoner cart, nestled in the Foothills area of the map. Should the wagon remain elusive, lean on Vision Scrolls or Find Distance items, available in town shops, dropped by enemies, or carried by specific characters such as the Scholar. Employ these tools to meticulously scrutinize the Foothills. Continue your exploration of the Foothills until you stumble upon the broken wagon. Once uncovered, assign any of your party members to investigate – no battle ensues, sparing your entire party from involvement. A notification will prompt you to the exact location of the Bandit Camp, where Hildegard's husband is being held captive. Liberate him from the camp to successfully fulfill this objective. These are the crucial steps to unraveling the mystery of Hildegard's husband in For the King 2. If you found this guide beneficial, consider exploring our diverse range of other informative guides.](https://meropaper.com/wp-content/uploads/2024/01/for-the-king-2-hildegard-husband-cart2-150x150.webp)