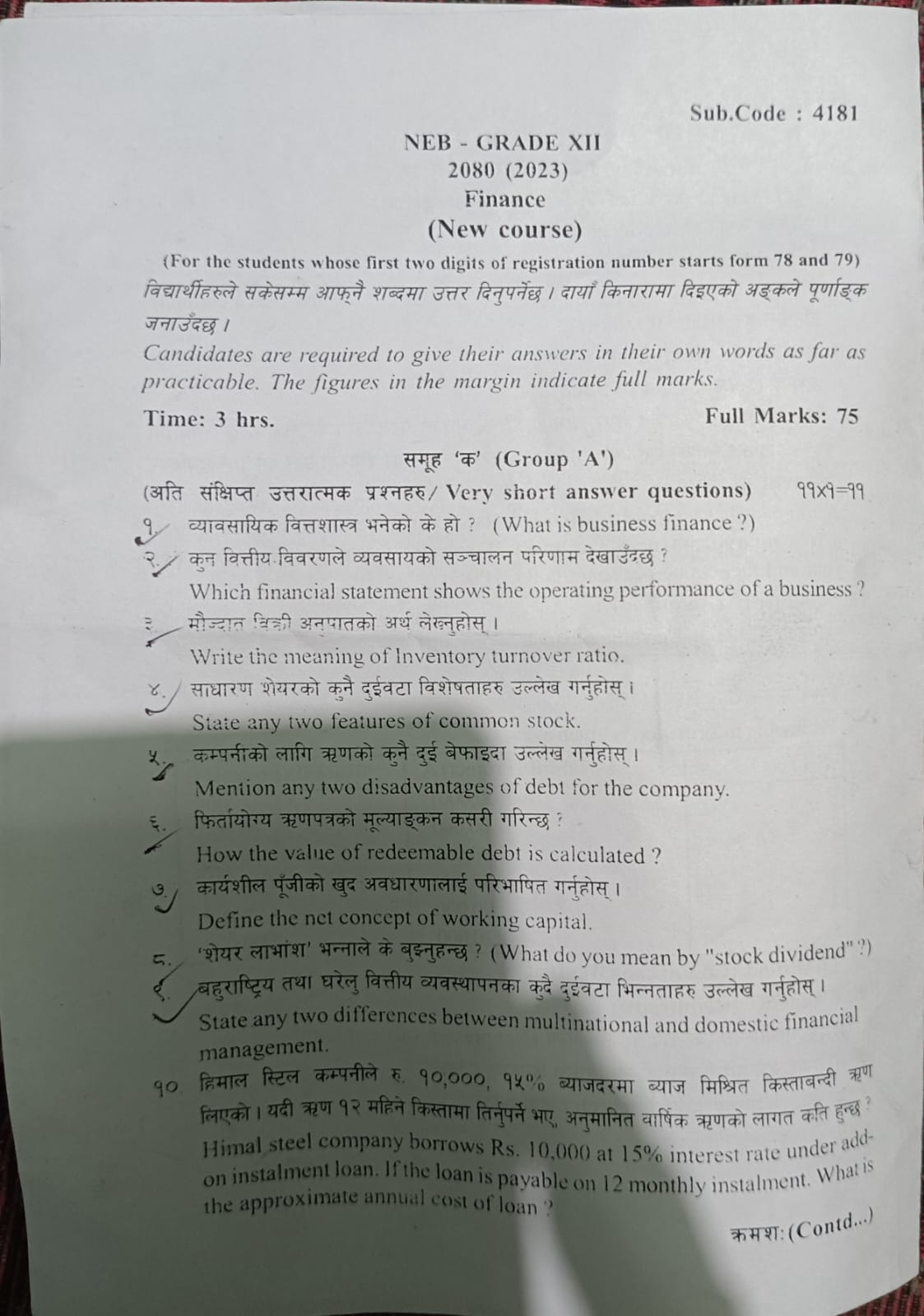

Group A

A . Very short Answer Questions (11*1 =11)

- What is business finance ?

- which financial statements show the operating performance of business ?

- Write the meaning of Inventory turnover ratio ?

- State any two features of common stock ?

- Mention any two disadvantages of deft for the company ?

- How the value of redeemable deft is calculated ?

- Define the net concept of working capital ?

- What do you mean by “stock dividend ” ?

- State any two differences between multinational and domestic financial management ?

- Himal steel company borrows Rs 10000 at the 15% interest rate under add on installment loan . If the loan is payable on 12 monthly installment . What is the approximate annual cost of loan ?

- You want to import 100 laptops from Japan .cost per laptop 48000 yen in Japan . If the current exchange rate is rs 12 per 10 yen . How much should you pay for 100 Laptops ?

Must read NEB 12 !! New project ,replacement project and Diversification project || Finance Important Notes

Concept Of Macroeconomics (notes)

https://meropaper.com/business-entity-and-financial-environment-financial-enviroment-notes/

Group B

B . Short answer questions (8*5=40)

- Assume you are appoint as a financial manager of a Company .What kind of roles will you play for financial planning and control ?

- How do you prepare income statement . Illustrate ?

- Explain main features of short term financing ?

- B company has average selling price per unit is Rs. 250 ,variable cost per unit Rs 200 and fixed cost is Rs 450000 . Find out Break even point in unit And in Rs .

- Write about new project ,replacement project and diversification project ?

- C company has an inventory conversion period of 50 days ,receivable conversion period of 25 days and payable deferral period is 15 days

Required : a. Operating cycle

b. Cash conversion cycle

7. Explain any five factors influencing dividend decision ?

8. Define spot rate and forward rate and distinguish between spot rate and forward rate ?

or

Consider the following exchange rate

US Dollor 1.00= Euro 0.8934

Canadian Dollor 1.3515= US Dollor 1.00

What is the cross rate of Euros to Canadian Dollors ?

Group C

C . Long answers Questions ( 3*8=24)

- The following financial information of a company given as :

Current Assets Rs 80,000

Inventory Rs 40,000

Current Ratio 2 times

Fixed Asset Rs 4,00,000

Long Term dept Rs 1,00,000

Sales Rs 6,00,000

Net Profit Rs 60,000

Required (solve)

- Current liabilities

- Liquid Ratio

- Dept-Equity ratio

- Fixed assets Turnover Ratio

- Return on Equity

- Return on Capital Employed

- Inventory turnover ratio

2. What procedure is adopted for valuing zero coupon bond ? Explain with example ?

or

Following information related to bond are given :

Maturity period 7 year

par Value Rs 1,000

Interest Rate 0% (zero coupon)

Rate of return 12%

Then find ,

*Value of Bond

b . A company has just paid a dividend of Rs 25 per share ,shareholders required a 16 % return from their investment . If expected rate of growth is 10% per year and face value per share is Rs 100 .

Required

Value of stock at present

3. Following information is given as :

| Year | Project A | Project B |

| 0 | 5,00,000 | 5,00,000 |

| 1 | 2,00,000 | 90,000 |

| 2 | 1,00,000 | 80,000 |

| 3 | 80,000 | 1,20,000 |

| 4 | 90,000 | 1,00,000 |

| 5 | 1,20,000 | 2,00,000 |

Cost of Capital : 10 %

Required

- Net present value of both projects

- Which project do you prefer and why ?

Note You Can Also download Question Paper here Neb 12 Finance Paper 2080

- [Resolving the Adventure Not Found Error in For the King 2](#) - [Understanding the Purpose of the Hardwork Skill in For the King 2](#) Upon liberating the prisoner from the cart in The Resistance chapter, the world unfurls for exploration. Roam the area until you chance upon an overturned wagon distinct from the prisoner cart, nestled in the Foothills area of the map. Should the wagon remain elusive, lean on Vision Scrolls or Find Distance items, available in town shops, dropped by enemies, or carried by specific characters such as the Scholar. Employ these tools to meticulously scrutinize the Foothills. Continue your exploration of the Foothills until you stumble upon the broken wagon. Once uncovered, assign any of your party members to investigate – no battle ensues, sparing your entire party from involvement. A notification will prompt you to the exact location of the Bandit Camp, where Hildegard's husband is being held captive. Liberate him from the camp to successfully fulfill this objective. These are the crucial steps to unraveling the mystery of Hildegard's husband in For the King 2. If you found this guide beneficial, consider exploring our diverse range of other informative guides.](https://meropaper.com/wp-content/uploads/2024/01/for-the-king-2-hildegard-husband-cart2-150x150.webp)